Get started with planning your financial future!

As independent investment planners, we are not limited to outdated investment products like the traditional banks are. That means we can utilize any portfolio to help achieve your goals!

First, our software shows you a full picture of your current assets. From there, we develop a strong understanding of your income needs and identify the best strategy to grow your wealth. Your successful and comfortable future is our focus.

It takes less than 10 seconds to book a call and speak with an investment advisor today!

Roch Tranel

- Financial Planner of the Year for 25 Years at our Broker/Dealer

- World Leader Award 11 Years in a row at our Broker/Dealer

Tyler Braun

- Financial Planner of the Year for 4 Years at our Broker/Dealer

Investments as unique as our approach.

We can’t control market fluctuation, but we can control the income potential of your portfolio. Our investment strategy is built with the goal of increasing the income potential of your portfolio no matter how the markets are performing. Markets can fluctuate, just like your personal circumstances, so don’t lose sleep over change.

The majority of the companies we invest with have above-average dividend growth. Across all of our models, we invest in 70 unique individual equity positions and 59 of those 70 positions have increased their dividend. None have decreased. Even when markets/investment allocations are down, the income power of their portfolio is up. By reinvesting a strong and ever-increasing dividend, you always own more shares and those shares are always paying out more in dividends, whether the account value is up, down, or sideways.

Our investment strategies have helped to make us one of the top investment management firms in the Chicago area. We focus on your needs and your growth, providing you with the most ideal outcomes for your future.

We strive to find that perfect balance of risk and reward.

When markets are up, you want to capture as much upside as possible and when markets are down, you want to capture as little of the downside as possible. Conservative allocations are designed to protect the downside and often capture little upside. Conversely, aggressive allocations are designed to capture a lot of upside, but will often capture all the downside. A capture ratio measures how an allocation performs overall in up and down markets.

When markets are up, you want to capture as much upside as possible and when markets are down, you want to capture as little of the downside as possible. Conservative allocations are designed to protect the downside and often capture little upside. Conversely, aggressive allocations are designed to capture a lot of upside, but will often capture all the downside. A capture ratio measures how an allocation performs overall in up and down markets.

Our equity focused portfolios offer great upside capture ratios when markets are strong. Our focus on recession-resistant sectors, quality dividend, and quality dividend growth rates allow our allocations to enjoy less downside capture when markets are weak.

Thanks in part to our tailored investment allocation strategies, we have become one of the top brokerage firms Chicago and the surrounding area has to offer.

Or

Wealth preservation and growth.

Two crucial components of a retirement investment strategy.

You only retire once. So when cracking open your nest egg, you have one chance to do it right. If you make a mistake, you likely won’t know until 10 or 15 years down the road. And then it’s too late. The most common mistake? Retirees treat their nest egg as one lump sum of money. There are costly pitfalls with investing, managing and thinking about your money in this manner.

For example:

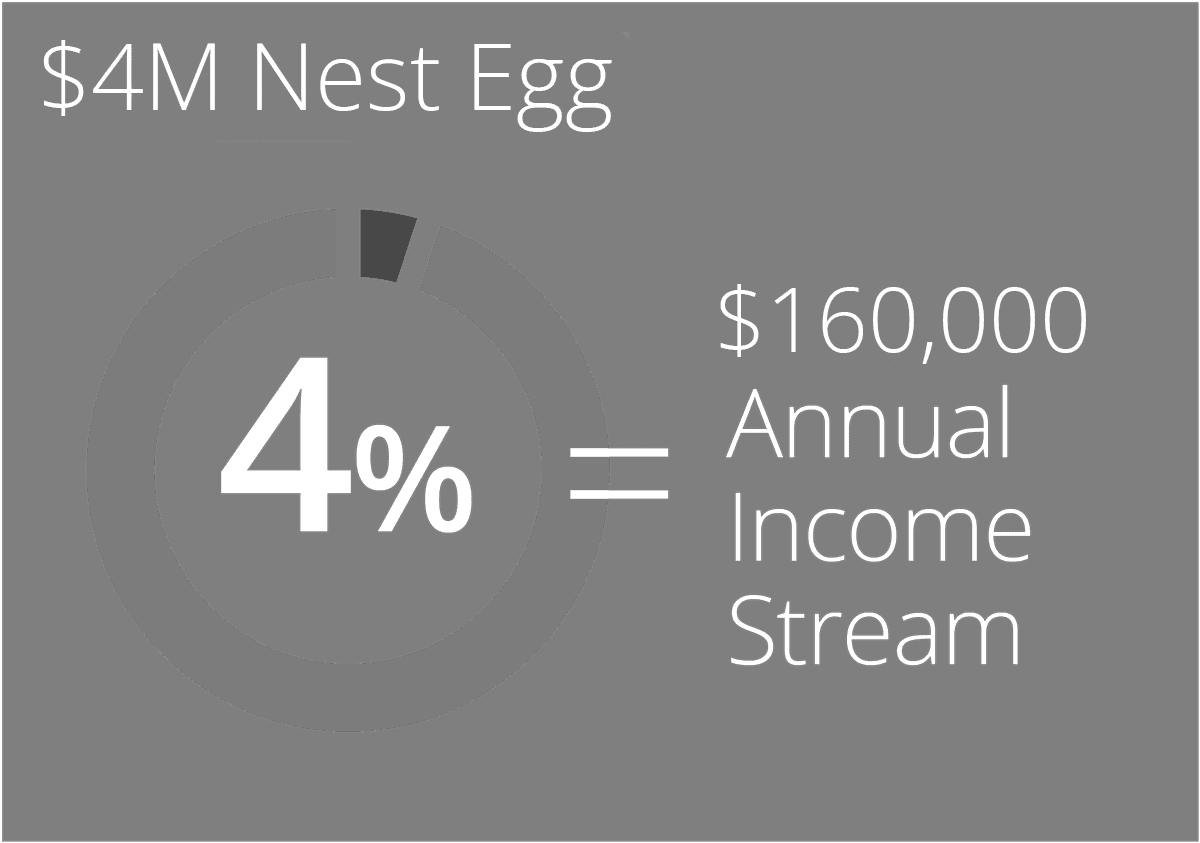

Say you have a $4 million nest egg. You decide to withdraw a 4% income stream from your nest egg every year to live the lifestyle you desire.

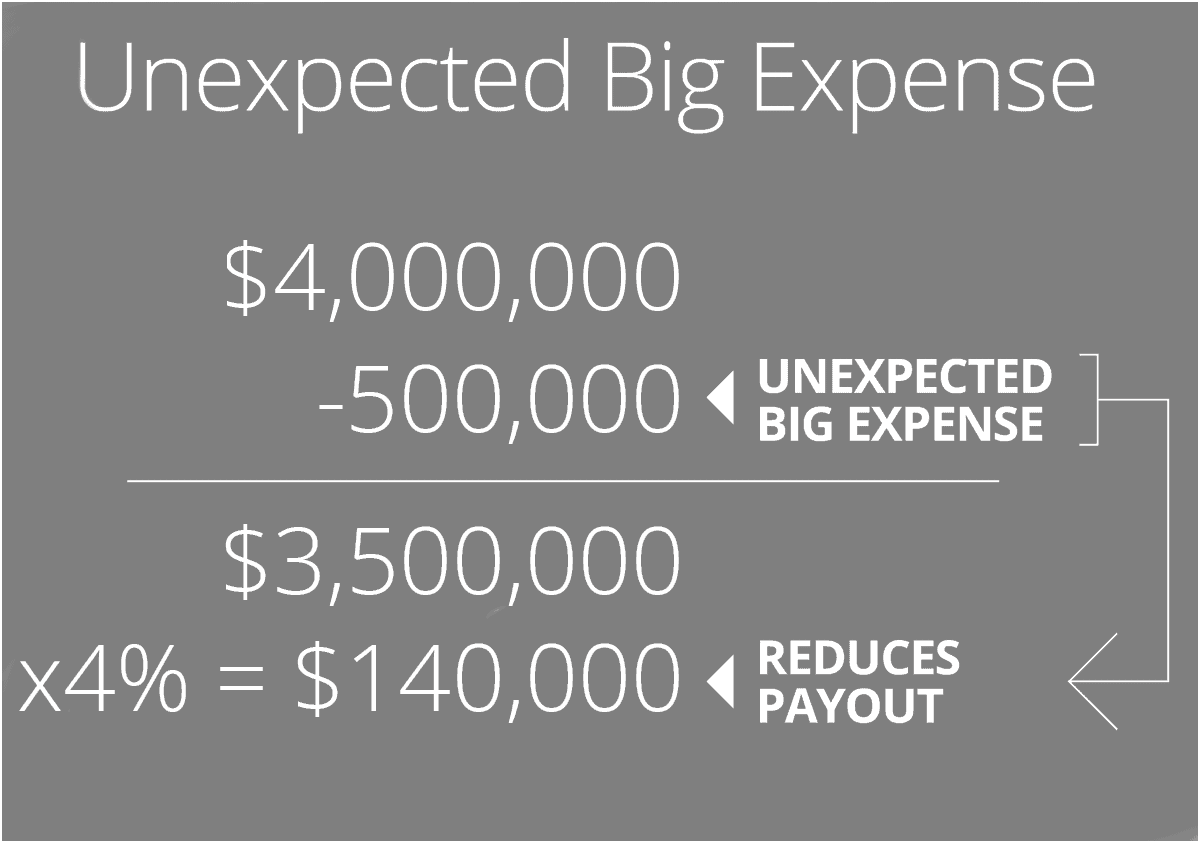

After a year, say a large unexpected expense comes up. Now you need to withdraw an additional $500,000 cash beyond your monthly income. This brings your nest egg’s relative value down to $3,500,000, reducing your yearly payout. You just gave yourself a pay cut in retirement. That’s the last thing you want to do—especially since inflation increases the cost of living during your 20–30 years of retirement.

A raise in retirement? Here’s how our strategy can make that possible.

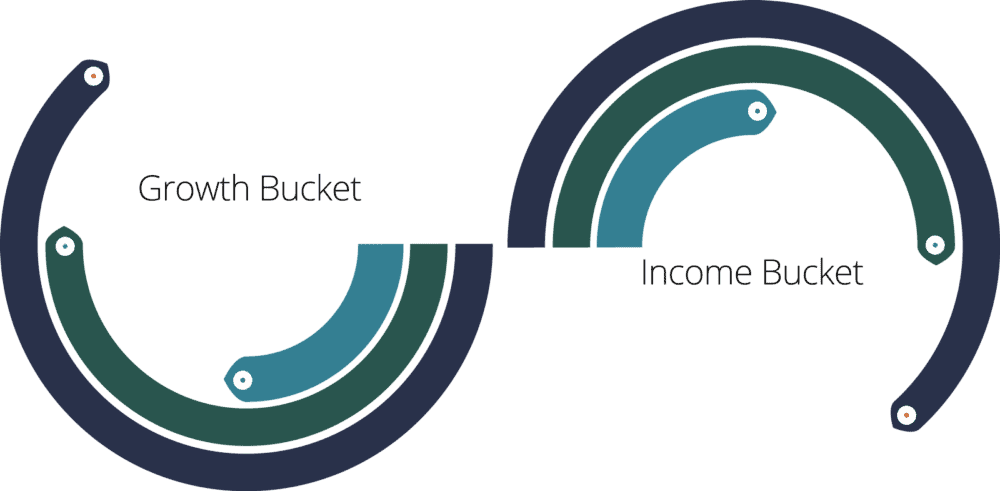

To address these challenges, we divide your nest egg into two buckets.

Income Bucket:

Money to draw income from during retirement. Since you rely on this money to live your life, it’s invested in moderately conservative allocations.

Growth Bucket:

Money set aside to grow through moderately aggressive allocations. Gains are protected by moving them to the Income bucket.

Dividing your nest egg into these buckets helps accomplish several significant things.

1. Withdrawing money from the Growth bucket for unexpected expenses leaves your income stream unaffected.

2. Gains from the aggressive Growth bucket are moved to the conservative Income bucket to protect them.

3. Shifting gains from Growth to Income increases the Income bucket’s bottom line. You just gave yourself a raise!