Personalized Financial Plan

Understanding a Personalized Financial Plan

At The Tranel Financial Group, we believe that a Personalized Financial Plan is not just a set of documents but a roadmap laid out for navigating through one's financial journey with clarity and confidence. Our approach is to deeply understand your dreams, aspirations, and fears, tailoring a plan that aligns with your unique life situations. We guide you through every step, ensuring that you're not just following a path but understanding it.

Setting Financial Goals

When it comes to a Personalized Financial Plan, the first step is always about setting clear, achievable financial goals. This is akin to setting the destination in your navigation app. Without knowing where you want to go, it's hard to map out a route. Our team works with you to identify short-term needs and long-term aspirations, whether it's buying a home, saving for your child's education, or ensuring a comfortable retirement.

Your goals are not just bullet points on a list; they are the milestones of your life's journey. And as your life evolves, so will your goals. That's why revisiting and revising these goals is an integral part of our process.

Budgeting and Spending

Think of your budget not as a constraint but as a way to direct your hard-earned money towards your goals efficiently. Crafting a budget is an art and science, balancing needs, wants, and savings. We work with you to create a realistic budget that not only addresses your current financial situation but also paves the way for future prosperity.

Our tools and resources, including downloadable budgeting sheets, are designed to offer clarity and simplicity in managing your finances. Our aim is not to restrict your spending but to empower you to make informed decisions that align with your financial aspirations.

Tackling Debt

Managing and Paying Off Debt

Debt can be a significant roadblock on your path to financial freedom. A Personalized Financial Plan includes strategies for not just managing but conquering debt. From low-interest consolidation strategies to prioritizing higher-interest debts, we guide you through the maze of options available to reduce your financial burden.

Building a Long-term Debt Management Plan

Our approach transcends immediate relief, focusing also on avoiding future debt traps. Education and empowerment are key. We provide insights on how to make savvy borrowing decisions and maintain a healthy credit score, ensuring you remain in a position of financial strength.

Saving and Investing

Establishing an Emergency Fund

The unpredictability of life makes an emergency fund essential. We help you calculate an adequate reserve that ensures peace of mind. Whether it's an unforeseen medical expense or a sudden job loss, being prepared can make all the difference. Our calculator tools and saving strategies are designed to make this task manageable and effective.

Invest Beyond Traditional Savings

Investing is where your savings truly start working for you, helping you reach your financial goals faster. Our educational approach demystifies investing, helping you understand different investment vehicles and how they fit into your Personalized Financial Plan. From stocks and bonds to retirement accounts, we explore the avenues that align with your risk tolerance and timelines.

Protecting Your Assets

Insurance plays a crucial role in any Personalized Financial Plan. It's about preparing for the unexpected and ensuring that life's curveballs don't derail your financial wellbeing. Whether it's life, disability, or long-term care insurance, we help you understand your options and make choices that provide adequate coverage for you and your loved ones.

Our discussions go beyond premiums and policies. It's about securing a safety net that allows you to pursue your financial goals without hesitation.

Planning for the Future

Retirement Planning

Dreaming of a peaceful retirement? Planning is essential. Our retirement planning services are designed to make your golden years truly golden. We consider various factors, including your current age, expected retirement age, lifestyle choices, and more, to tailor a retirement plan that meets your expectations.

And with our ongoing education and support, you're not just planning for retirement; you're actively building the future you dream of.

Estate Planning

While often overlooked, estate planning is a cornerstone of a Personalized Financial Plan. It's not just about distributing your assets but ensuring that your wishes are honored. Whether it's setting up a will, establishing a trust, or making healthcare directives, we guide you through the choices to create a comprehensive plan that brings peace of mind to you and your loved ones.

Continuous Review and Adjustment

Financial planning is not a set-it-and-forget-it deal. Life changes, and so should your financial plan. Whether it's a new job, marriage, a growing family, or even a global economic shift, we stand by you, ready to adjust and recalibrate your Personalized Financial Plan to suit the new realities of your life.

Our commitment is to be your lifelong financial partner, adapting our strategies to meet your changing needs and aspirations.

Conclusion

At The Tranel Financial Group, we are more than financial planners; we are your coaches, allies, and cheerleaders on the path to financial well-being. A Personalized Financial Plan is more than a plan; it's a promise--a promise to strive for a secure and prosperous future, uniquely tailored to you. Let's embark on this journey together, with confidence and clarity leading the way.

Are you ready to take the first step? Contact us today, and let's start shaping a future that resonates with your dreams.

How do I create a personal financial plan?

Creating a personal financial plan begins with understanding your current financial situation and clarifying your financial goals. At The Tranel Financial Group, we like to start by painting a detailed picture of where you stand financially. It's like putting together a puzzle; every piece, from your income and expenses to your debts and assets, helps form the complete picture. Next, setting clear, achievable financial goals is crucial. We work with you to map these out, whether it's saving for a down payment on a house or planning for retirement. The key is to be specific about what you want to achieve and by when.

Remember, it's not just about numbers on a spreadsheet. It's about aligning your financial plan with your life's aspirations. Our team provides guidance on budgeting, debt management, saving, investing, and protecting your assets. We also emphasize the importance of continuous review and adjustment of your plan to reflect life changes. By following these steps, you're not just planning for your financial future; you're taking control of it.

Why is it important to develop a personalized financial plan?

Developing a personalized financial plan is crucial because it ensures that the financial strategy you follow is uniquely tailored to your life situation, goals, and preferences. Imagine wearing a suit made specifically for you, compared to one picked off a store rack. The difference in fit and comfort is night and day. Similarly, a financial plan that's personalized fits your financial situation perfectly. It considers your current resources, your future aspirations, and even the unexpected twists life might throw your way.

At The Tranel Financial Group, we understand that each person's dreams, fears, and circumstances are unique. A personalized financial plan not only helps you navigate through your financial journey more confidently but also empowers you to make informed decisions that align with your life's goals. It's about creating a roadmap that adapts as your life evolves, ensuring that your financial well-being is always aligned with your changing needs and aspirations.

What is the 50-30-20 rule?

The 50-30-20 rule is a simple yet effective way to budget your income. It suggests allocating 50% of your income to necessities, such as rent, utilities, and groceries; 30% to wants, like dining out, entertainment, and hobbies; and the remaining 20% towards savings and debt repayment. Think of it as a guideline to help you manage your finances without feeling overwhelmed. It provides a structured approach to ensure you're covering your essential expenses while still allowing room for enjoyment and securing your financial future.

At The Tranel Financial Group, we often adjust these percentages to better fit an individual's unique situation. The beauty of a personalized financial plan is that it caters to your individual needs and goals. For some, saving a higher percentage is crucial for reaching their goals sooner, while others might need to allocate more towards debt repayment. The 50-30-20 rule is a starting point, and we tailor it to suit your life perfectly.

What does a good personal financial plan include?

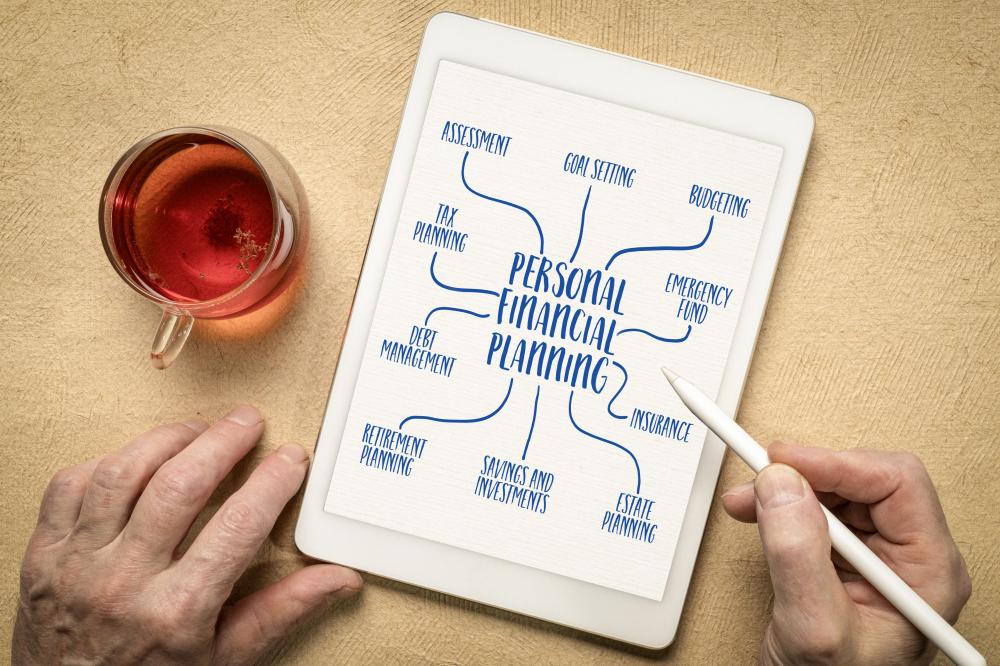

A good personal financial plan is comprehensive and holistic. It encompasses various components, including budgeting and spending, saving and investing, debt management, emergency fund establishment, insurance, retirement planning, and estate planning. However, at The Tranel Financial Group, we believe a truly effective plan goes beyond these elements.

A good plan is personalized, reflecting your unique financial situation, life goals, and aspirations. It includes a strategic approach to managing your finances today while planning for your future. It also adapts to life's changes, providing guidance and strategies to adjust your financial roadmap as needed. A good financial plan isn't just about the numbers; it's about providing peace of mind, empowering you with financial confidence, and helping you realize your dreams.

How can I tackle my debt most effectively?

Tackling debt effectively requires a strategic approach tailored to your unique financial situation. At The Tranel Financial Group, we encourage clients to start by listing all their debts, noting down the interest rates, balances, and minimum payments. From there, we explore various strategies. For many, focusing on the debt with the highest interest rate first, known as the avalanche method, saves money on interest over time. For others, the snowball method, starting with the smallest debt and working up, provides motivational victories that encourage persistence.

We also discuss consolidating debts to lower interest rates or renegotiating terms with creditors. It's not just about paying off what you owe; it's about doing so in a way that is sustainable and aligned with your broader financial goals. Remember, tackling debt is a significant step towards financial freedom, and we're here to guide you through every decision and strategy to make this journey as efficient and stress-free as possible.

Why is having an emergency fund so important?

Having an emergency fund is akin to wearing a life jacket while sailing; you hope you never need to use it, but its presence provides peace of mind and safety. In financial terms, it's your buffer against life's uncertainties--be it unexpected medical expenses, job loss, or urgent home repairs. An emergency fund helps you avoid the need to take on high-interest debt in times of crisis.

At The Tranel Financial Group, we advise clients on calculating an adequate emergency fund, typically three to six months' worth of living expenses, and more for those with less stable income streams. Establishing this fund is a foundational step in your personalized financial plan, ensuring you're prepared for whatever comes your way. It's not just about saving money; it's about securing your financial well-being and providing stability in turbulent times.

How often should I review and adjust my financial plan?

Reviewing and adjusting your financial plan regularly is crucial to ensure it remains aligned with your life's changes and financial goals. At The Tranel Financial Group, we recommend a comprehensive review at least annually or whenever you experience a significant life event, such as marriage, the birth of a child, a career change, or receiving an inheritance. This process allows us to recalibrate your financial strategies to match your current situation and aspirations.

Remember, a personalized financial plan is dynamic, not static. It evolves as your life unfolds. By regularly reviewing and adjusting your plan, you ensure it accurately reflects your current needs, goals, and circumstances, keeping you on the path toward financial well-being and success. It's a proactive approach to your financial future, ensuring you're always prepared for what's ahead.

Financial Resources

- USA.gov - Investing - Find information on investing and how to make informed financial decisions.

- Consumer Financial Protection Bureau - Provides resources and tools to help you make informed financial decisions and protect yourself from financial exploitation.

- 360 Degrees of Financial Literacy - Offers a wide range of financial planning resources and tools to help you manage your finances effectively.

- Investor.gov - Learn about investing, financial markets, and how to protect your investments.

- Office of the Comptroller of the Currency - Consumer Protection - Provides information on consumer protection in the financial sector and how to safeguard your finances.

- Internal Revenue Service (IRS) - Access tax information, forms, and resources to help you navigate the tax system and manage your finances efficiently.