Thinking Beyond Your Core Financial Strategies

Financial strategies are so much more than building a nest egg – it’s about weaving a tapestry of security and opportunity for those who come after you, it’s about leaving a legacy for your family. It’s about ensuring the values you hold dear and the legacy you wish to leave behind are translated into tangible ways for future generations. What are the best ways to give? We can walk you through how your legacy can live on.

- Estate tax planning helps ensure your wealth passes smoothly to loved ones, minimizing taxes.

- Gifting strategies can spread your assets out over time, potentially reducing your taxable estate.

- Multi-generational planning considers the needs of your children and even grandchildren, ensuring your legacy continues to provide for future generations. Avoiding probate, a lengthy court process, can be achieved through tools like living trusts.

- Roth conversions can move your retirement savings to a tax-free zone, allowing future generations to inherit them without owing taxes on the growth.

- By strategically filling up your lowest tax bracket and so much more!

WITH CAREFUL PLANNING, YOU CAN CREATE A LASTING LEGACY THAT BENEFITS YOUR FAMILY FOR GENERATIONS TO COME

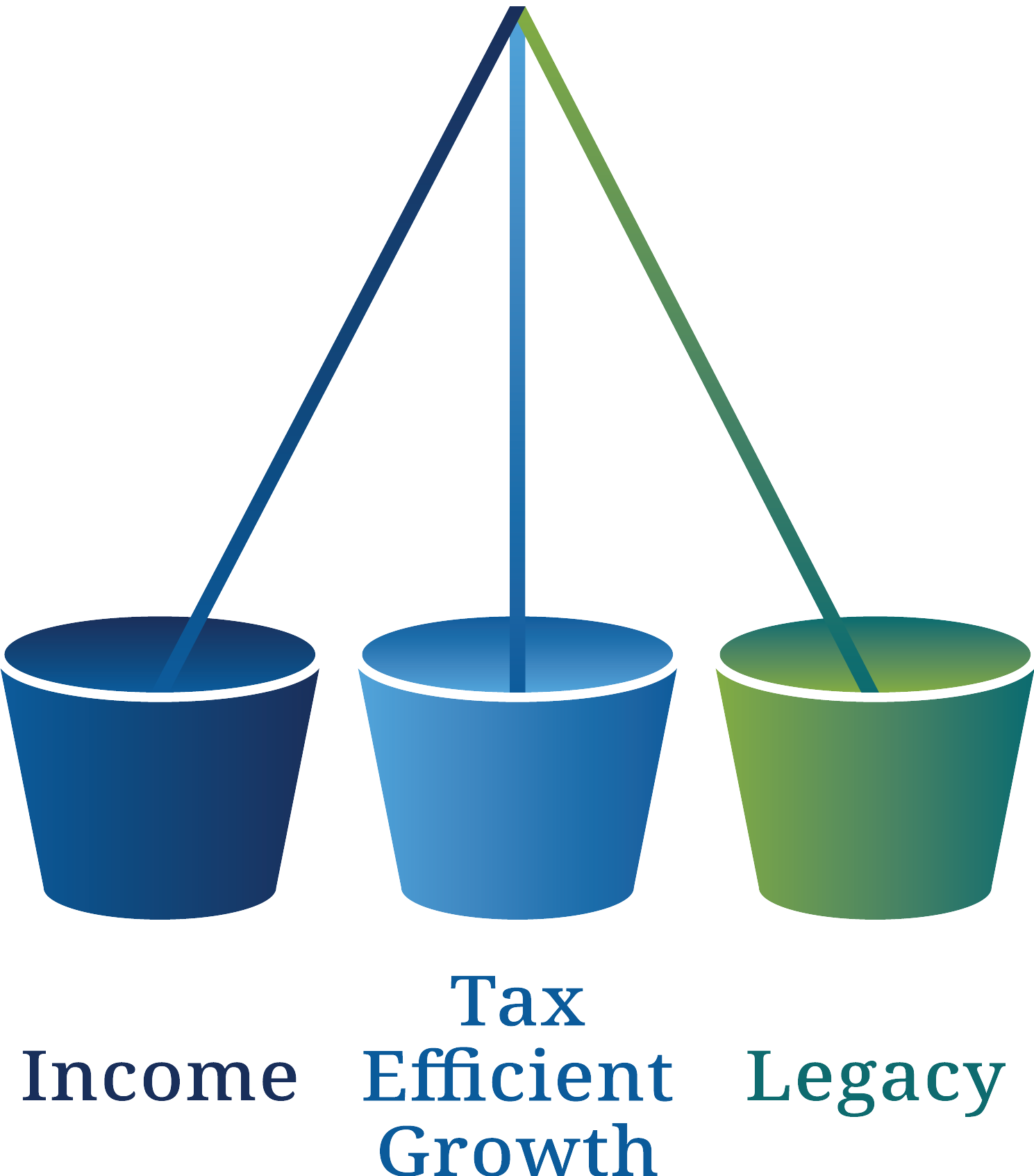

Our Strategies

Income

- Required Minimum Distribution

- Dividends Vs Not Qualified?

- Long Term Cap Gains vs Ordinary Income

Tax Efficient Growth

- Long Growth-Steady Accumulation

- Double Compound

- Dollar Cost Averaging

- Tax Loss Harvesting

- Assets From Right Bucket

Legacy

- Life Insurance Become Asset

- Estate Tax Planning

- Gifting

- Multi Generational Planning

- Helping To Avoid Probate

- Roth Conversion

- Filling Up The Lowest Tax Bracket

- Lowest Tax On Required

Minimum Distribution

Of the growth and income buckets above, those are part of your core financial planning system. Having a core financial plan to build your nest-egg is important to help ensure that your family is taken care of now. The legacy bucket is to help ensure your family is taken care of after you are gone.

Retirement

Planning You

Need

Helping

people achieve

their goals

SCHEDULE AN APPOINTMENT

TODAY TO START YOUR STRATEGY

Every aspect of life has a financial component – it’s no wonder you can feel overwhelmed. Maybe you’re considering looking into the wealth management advisors Chicago trusts for the first time. Or maybe you already have someone – a wealth advisor you’ve worked with for years or an insurance agent. But how well do they know your hopes, dreams, fears, and frustrations? Or worse, do they care? At Tranel, you are never a number. It’s your definition of success that defines ours. Because every person and situation is unique.

Through a collaborative process, we help you define your ideal financial self and then help get you there. We empower you with the knowledge, tools and strategies necessary to reach your goals – because success encompasses the monetary and the personal. We want you to have enough money to take care of your responsibilities, but also to reach your purpose and leave a legacy.